I’m not a fan of any technology that uses my “personal” information to sell me things, or worse, allows others to know my personal information to sell me things… yet in many ways I have been doing this my whole career in Advertising, and it has been happening to me. For example, how many times have you ordered something online, received a catalog from that company, and then 5 others from related companies? I guess the difference in that scenario is the fine print I never read that explains company A has the right to sell my information if I provide it, and in this one, there is nothing I have seen about opting in or out of allowing your online purchase history to be sellable by the credit card company you use. I also dont like that if I buy a Big Mac, they will target me with weight loss information, and if I were McDonald’s I would probably have an issue with that as well. If I buy a Big Mac, why not target me with an ad for free french fries with my next Big Mac purchase? Who died and made Visa my guilty conscience?

I find it interesting that this conversation is being applied to selling the data to other companies for online marketing, and not for the credit card companies’ personal use for more targeted transpromo print marketing on their statements and digital marketing on their websites where people pay bills. Content might be king, but data like this is cash, and seems they are giving away a huge opportunity to be the hub of the marketing dollars and of course use print to deliver the same advertising on what they are already printing!

By EMILY STEEL

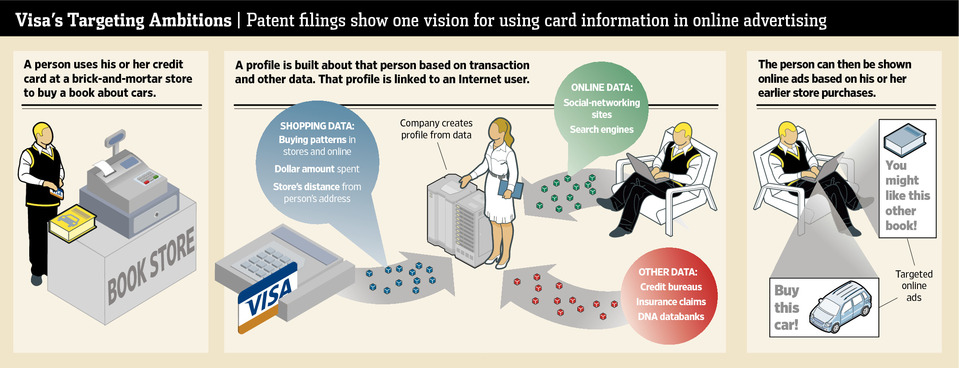

The two largest credit-card networks, Visa Inc. and MasterCard Inc., are pushing into a new business: using what they know about people’s credit-card purchases for targeting them with ads online.

Their plans, if implemented, would represent not only a technological feat—tying people’s Internet lives with shopping activities—but also an erosion of the idea of anonymity on the Web. It’s an effort by the two companies to profit by selling access to the insights they gather about people with every credit-card transaction.

The technology is still evolving. According to ad executives briefed on some of the ideas, a holy grail would be to show, for instance, a weight-loss ad to a person who just swiped their card at a fast-food chain—then track whether that person bought the advertised products. Currently, Web ads generally are based on a person’s online behavior but not information tied to his or her identity or activities in the brick-and-mortar world.

In one particularly futuristic idea, a Visa patent application published this year describes incorporating information from DNA databanks, among other personal details, into profiles that could be used to target people online.

MasterCard earlier this year proposed an idea to ad executives to link Internet users to information about actual purchase behaviors for ad targeting, according to a MasterCard document and executives at some of the world’s largest ad companies who were involved in the talks. “You are what you buy,” the MasterCard document says.

Continues at: Using Credit Cards to Target Web Ads – WSJ.com.

Related articles

- WSJ: Visa, MasterCard Looking Into Online Targeted Advertising Using Credit-Card Data (anisekirkpatrick.wordpress.com)

- Visa and MasterCard want to target advertising based on personal credit card transaction histories (daveibsen.typepad.com)

- Vista, MasterCard Plan to link Credit Card Purchases And Online Marketing (ghacks.net)

- Visa & Mastercard Looking into Linking Ad Targeting to Purchases (searchenginewatch.com)

- Credit Card Records (stallman.org)

- Targeted Web Ads Tied to Your Credit Card Buys (bigthink.com)

- Rockefeller Asks Credit Card Companies About Behavioral Targeting Plans (mediapost.com)

- Visa, MasterCard to use buying history for ad targeting? | The Digital Home – CNET News (mbcalyn.com)

- Mastercard, Visa To Help Target Ads (yro.slashdot.org)

- MasterCard, Visa Aim to Sell Insights Into People’s Shopping (online.wsj.com)